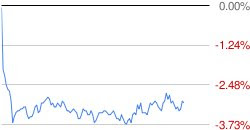

Stocks tumbled Tuesday as investors faced a fresh sign of the deepening recession and dilution worries gnawed at bank stocks.The Dow Jones Industrial Average was down more than 200 points, or nearly 3 percent. The S&P 500 shed about 4 percent and the tech-heavy Nasdaq lost more than 3 percent.That put the Dow around 7,600 and the S&P below 800, levels not seen since November. Still, both had a way to go before breeching the November lows around 7,450 and 740, respectively.

Stocks tumbled Tuesday as investors faced a fresh sign of the deepening recession and dilution worries gnawed at bank stocks.The Dow Jones Industrial Average was down more than 200 points, or nearly 3 percent. The S&P 500 shed about 4 percent and the tech-heavy Nasdaq lost more than 3 percent.That put the Dow around 7,600 and the S&P below 800, levels not seen since November. Still, both had a way to go before breeching the November lows around 7,450 and 740, respectively.>> Are We Headed for a New Low?

This comes after last week's 5.3-percent drop in the Dow as few details on the execution of the stimulus plan and worries about the potential for wiping out bank stocks weighed on the market. Financials were the week's worst performer, down 10 percent, while health care was the best, down just 2.4 percent."Today feels like another shot to the gut," Michael Farr, president of Farr, Miller & Washington, wrote in a guest blog post. But here's the news flash: "It's too late to panic," Farr writes."Play defense, but PLAY!" Farr wrote.The latest sign of the deepening recession came from the New York Federal Reserve, which reported its Empire State manufacturing index fell to a record minus-34.65 from minus-22.2 in January. Economists had expected a much milder decline of minus-24. New orders fell to an all-time low.This report from the New York Fed, along with a reading from the Philadelphia Fed later this week, is closely watched as a precursor to the national reading from the Institute for Supply Management, due out in two weeks.Worries about more bank nationalizations also weighed on investors returning from the three-day weekend after markets were closed for Presidents' Day Monday.

By: Cindy Perman, CNBC.com

To read more go to:

As in the days of Noah...

.bmp)

.bmp)